“Where Your Taxes Go”

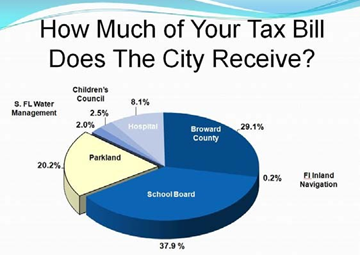

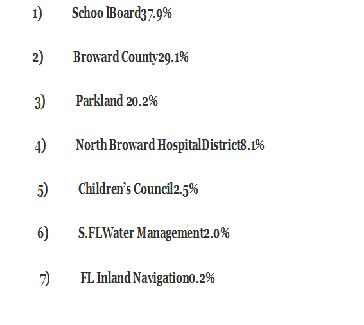

Did you know for each dollar($1.00)you pay in property taxes the City of Parkland only receives twenty‐cents($0.20).

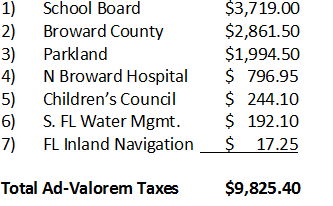

Your property taxes(advalorem taxes) are distributed amongst seven(7) taxing authorities in Broward County.

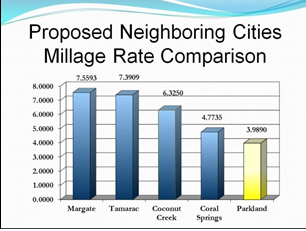

The City o f Parkland has the lowest millage rate when compared to our neighboring Cities. Parkland has the 4th lowest millage rate in all of Broward County.

What is a millage rate?

The millage rate is the amount of property tax charged per$1,000 of taxable value. For example, the City’s proposed millage rate is $3.989 per $1,000 of taxable value.For each taxable value of $100,000, a property owner would pay$398.90.