Real Estate Market In Parkland, Greater Fort Lauderdale, Boca Raton, Weston and Coral Springs

In Greater Fort Lauderdale and Miami, the housing market over the last five years has been marked by a shortage of homes for sale and ever-rising prices. This dynamic has been especially prevalent in coastal markets like New York, San Francisco, and Los Angeles, which tend to be expensive anyway. We all felt this locally in Parkland, Weston, Coral Springs and Boca Raton as well.

Call a professional full time realtor like Lea and Melissa to help you understand the current Real Estate Market melissa@melissahoffpa.com | 954-817-8401 at Leaplotkin@gmail.com | 954-295-8015.

Expectations were that this was going to continue, but in 2018, the market started to cool. This past summer—usually a busy season for home-buying—was suppose to be “the most competitive housing market in recorded history,” according to one realtor, with prospective buyers engaging in bidding wars over the few houses that were for sale.

That didn’t pan out, suggesting that home prices have finally risen beyond what people can actually pay; wages have risen at a much slower clip than home prices. The housing market follows the old economic principle of price being a function of supply and demand, and demand is strong with the economy doing well and older millennials finally entering stages of life that lead to buying a home.

This fall, those same markets saw median listings prices drop considerably. It’s important to distinguish the difference between a listings price and a sale price, because listings prices can still be bid up, but usually listings prices are leading indicator as to where home prices are headed.

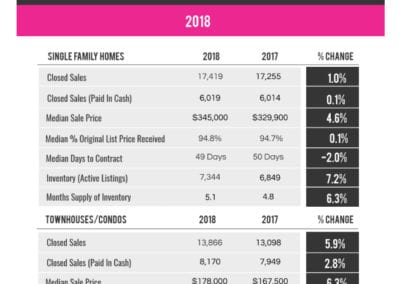

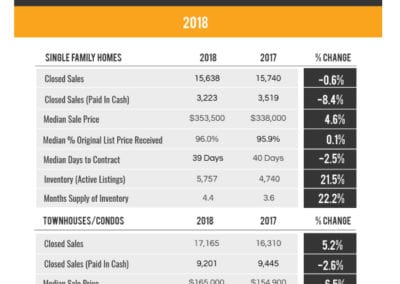

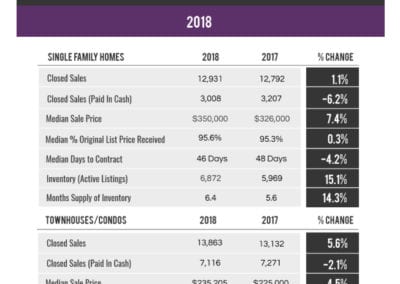

Call a professional full time realtor like Lea and Melissa to help you understand the current Real Estate Market melissa@melissahoffpa.com | 954-817-8401 at Leaplotkin@gmail.com | 954-295-8015. We are now in Mid February and can see last years numbers in the charts above. While in last weeks Saturday morning video we spoke of January statistics.

If that holds true, in 2019 home prices could drop, not like they did in 2008, but definitely down. Sellers trying to get sale prices like we had in 2017, unfortunately missed their time.

Speaking of the 2008 housing collapse, one might naturally be alarmed by the prospect of a housing slowdown, given the financial calamity that occurred as a result of the last housing slowdown. But conditions today are almost the complete inverse of conditions in 2008.