Real Estate conditions in Parkland Florida & Coral Springs Florida like the rest of the country will continue to get better and see a recovery in 2014. The interest rates and home prices are predicted to rise but very slowly. The Real Estate market in Parkland Florida & Coral Springs Florida will continue on its road to recovery in 2014, with home prices rising approximately 6 percent per year and mortgage rates hitting 5.4 percent. We will see home buyers demand and inventory stabilize as market conditions stay their coarse in Parkland Florida & Coral Springs Florida in the next 60 days.

We have seen the low inventory levels and very erratic data of real estate market in Parkland Florida & Coral Springs Florida with levels plateauing in this last 60days . This is what everyone is predicting including Lawrence Yun, chief economist and senior vice president of Research for the National Association of REALTORS®, who presented his 2014 market forecast during last week’s REALTORS® Conference and Expo.

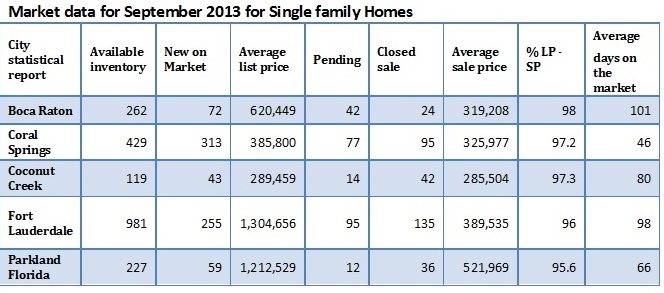

Real estate market Conditions for Parkland Florida & Coral Springs Florida stats

The goal is to se.t the real estate market in Coral Springs Florida and Parkland Florida and the rest of the country back on the right path and stabilize the swings. Although there could be some negative impact on the horizon due to rising mortgage rates, slow job creation and loosening underwriting standards in the end the result should balance out in 2014’s sales volume. “There were two million jobs created in the past few months and we’ll see the same next year,” says Yun. “These people could potentially enter the real estate market.

”The Real Estate market in Parkland Florida & Coral Springs Florida is a doing much better than the rest of the country as you can see by the chart above. The price gains of this past year are steadily getting entrenched.

This past week we saw that Janet Yellin will be nominated to be the next chairman of the Federal Reserve. She signaled she will carry on the central bank’s unprecedented stimulus until she sees improvement in an economy that’s operating well below potential.“A strong recovery will ultimately enable the Fed to reduce its monetary accommodation and reliance on unconventional policy tools such as asset purchases,” Yellen said “Supporting the recovery today is the surest path to returning to a more normal approach to monetary policy.”Yellen, the Fed’s vice chairman, voiced her commitment to using bond purchases known as quantitative easing to boost growth and lower unemployment that remains above 7 percent more than four years after the economy began to recover from the deepest recession since the Great Depression. this will hep Real Estate market conditions in Parkland Florida & Coral Springs Florida in this next few months heading in to 2014