January 2020

Assessment Limitation & Homestead Portability and When to File for Homestead and other Exemptions – Homestead Exemption and Portability for Parkland, Boca Raton, Coral Springs

Did you know that all legal Florida residents are eligible for a Homestead Exemption on just about any type of property including a single-family home, condominiums, co-op apartments, and eligible mobile home lots?

Homestead Exemption and Portability for Parkland, Boca Raton, Coral Springs

The filing date for 2020 is March 2 however, there is a deadline for late filings no later than September 18, 2020.

The Homestead Exemption saves property owners thousands of dollars in taxes each year. When buying real estate, property taxes will not always remain the same. A change in ownership may reset the assessed value of a home to full market value, which could result in a higher or lower property tax bill.

If you plan on choosing a Homestead exemption, all homeowners occupying the property as tenants-in-common must file on the jointly-held property to claim 100% coverage. Even if you are married, it’s important to have all eligible owner-occupants file. You must have:

Proof of ownership either a notarized certificate of trust, the recorded deed or co-op proprietary lease and proof of permanent Florida residents either in the form of a Florida driver’s license, voter registration, or recorded declaration of domicile. For non-US citizens, you must have as many items above and proof of permanent residency or proof that you are a parent of a US-born citizen.

Florida property owners with the Homestead Exemption are able to receive a benefit known as the Save Our Homes (SOH) assessment limitation. The SOH cap limits the amount the annual assessment on a home can be increased, to a maximum of 3% regardless of how much the market value of the home has increased.

If two people with their own homesteads decide to abandon their homesteaded properties and purchase a property together, the property appraiser will use whichever prior homestead would result in the highest cap differential, which would yield the highest tax savings.

Calculating the Transfer of Homestead Assessment Difference

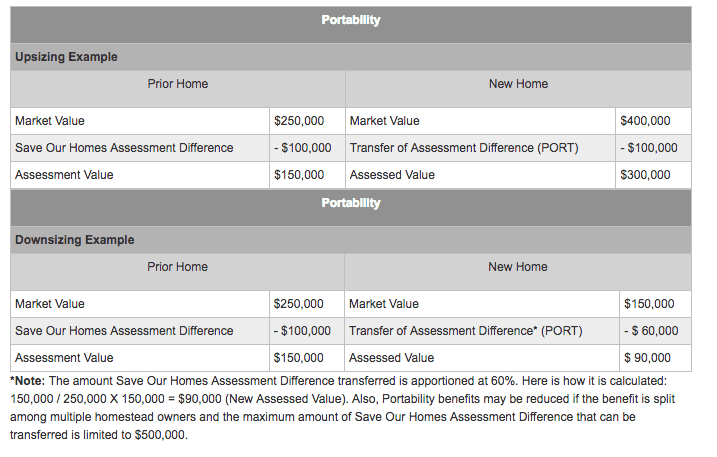

Generally, there are two major components in calculating portability – upsizing and downsizing.

__________________________________________________________________

Property Tax and Portability

Property taxes are due. Most of you have probably received your property tax bill in the mail. It will say on the outside “this is your tax bill”. So, just a couple quick things to point out with the property taxes – first off, if you have an escrow account – that’s where your lender is collecting on a monthly basis, your taxes and insurance – you’re still going to receive this bill but don’t panic, your bank or lender also received it. You should see that post at the end of November or at the beginning of December as all banks usually send those checks out at the end of the month.

Another thing to point out – if you bought a house in 2019, remember, this tax bill that you’re receiving is the previous owner’s tax bill – you inherited their tax bill for 2019. So, if it’s a very low amount and that previous owner had lived there for many, many years, just remember this tax bill is going to be based on what they paid for the property. You’re not going to get reassessed until next year. So it’s important to know that, because you may have a really low tax bill this year – don’t get comfortable with that if you just bought, because it is going to change next year in 2020. It could also be the reverse, right – you might have bought from an investor or someone who didn’t have the home as their homesteaded property – the tax bill could be a little higher. Therefore, you’re going to get a break next year when you file your homestead and that will go into effect for 2020.

It’s important to note that Homestead Exemption does not transfer from property to property. If a homeowner received this exemption on a prior year on another property and then moved, the new homeowner must file a new application for the new residence. Homeowners are to notify the property appraiser to cancel any exemptions on the prior home. Each homeowner must apply for their own exemptions.

Florida’s Probability Law will allow property owners to transfer their “save our homes” benefit earned on a previous Homestead property to their new homestead property. If homeowners are applying for a new exemption and have held a previous exemption within the last two years anywhere in the state, they should also submit a portability application with their Homestead application. This will transfer any tax savings that the homeowner has earned but does not transfer the exemption from one property to another.

For more information feel free to visit the Property Appraiser website or contact my office for more information below.